This Simple, 6-Step Process Is The One Clear Path To Consistent Cash Flow In Your Business

by Todd Henry, CPA

Follow this "formula" to dramatically improve your revenue, profit and cash flow, all while stripping away the guesswork, stress and overwhelm from running your business.

It's true that 91% of small businesses fail. Most of them within their first 5 years. (This is according to the U.S. Bureau of Labor Statistics.). By year 10, they're virtually all gone.

Think about it...

All the money invested... Gone. (Maybe your life savings along with it.)

All the time, energy and effort spent... Gone.

All those hopes, dreams and aspirations... Well, you get it. They are gone, too.

But that doesn't have to be YOU. In fact, it turns out that there's just one thing that all those failed businesses have in common that, if you address appropriately, you can protect your business against and make it virtually impossible for you to fail.

Are you ready to learn what that one thing is that all defunct businesses have in common?

I'll tell you: it's the lack of consistent, positive cash flow.

Think about it...

Cash flow solves every single problem in business.

Have a marketing problem? Cash flow allows you to focus on marketing ROI and hire top-level talent to manage it for you.

Have a management problem? Cash flow allows you to hire more and/or better managers to run the day-to-day while you focus on your business.

Have a recessionary problem? Cash flow allows you to weather the storm.

Have a seasonal problem? Cash flow allows you to make it to the busy season.

Have a sales problem? Cash flow allows you to improve your product and/or hire more and better sales people.

You get the idea... Cash flow fixes ALL problems in your business. (It also puts money in your pocket because, when cash flow is strong, you can take distributions... Isn't that why you started the business in the first place?)

So, the question is, how do you ensure that YOUR business doesn't suffer from a lack of cash flow?

Is there a one clear path to healthy, consistent cash flow?

In fact, there is...

The One Clear Path

An interesting thing happened after 20 years of working in public accounting and corporate finance (for and in companies large and small, across every industry, under virtually every ownership structure, etc.)...

I discovered a pattern. One that seemed to determine, with scary precision, whether a company would ultimately succeed in hitting its strategic goals, or whether it'd underperform or outright fail.

That pattern went something like this:

1. Set specific financial goals (targets) for the period (month/quarter/year).

2. Measure and record actual performance throughout the period.

3. Compare actual performance to targeted performance (often called variance- or flux analyses) throughout the period.

4. Identify what's working and what isn't.

5. Course correct where things aren't working, double down where things are.

6. Repeat steps 2-5.

More or less, that's what the successful companies I've worked with and for did, and it's what the unsuccessful businesses didn't do.

What's fascinating, though, is that none of these businesses seemed to be aware of what they were or weren't doing right... It was just intuitive, as it were.

But over time, I was able to see this pattern emerge, and it inspired me to refine it into what I call the One Clear Path, a process that any business, of virtually any size, can follow to have a growing and successful business that is practically bulletproof against failure.

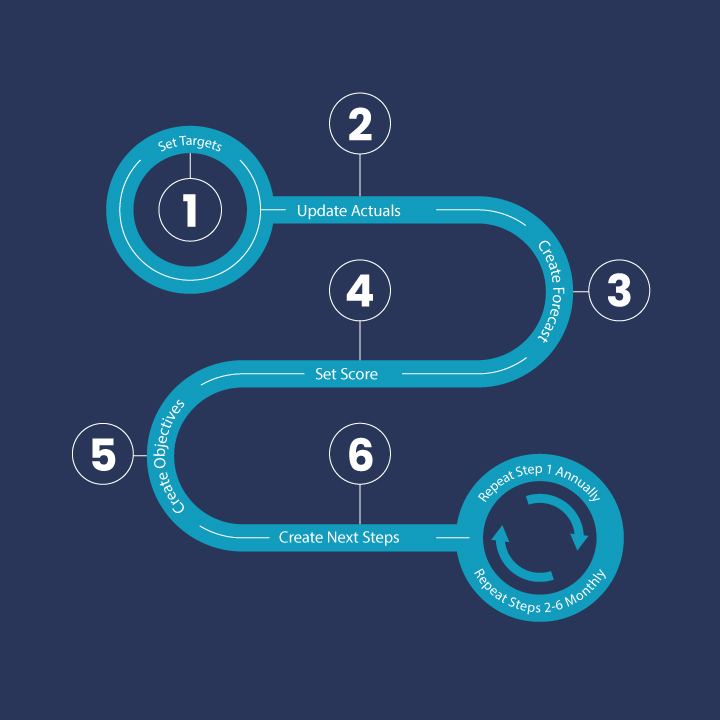

The One Clear Path is essentially what I outlined above (numbers 1-6), only significantly refined. Here's an infographic to illustrate the process:

As you can see, it's also 6 simple steps, all more or less underlying the same process...

But the enhancements lie in the details. Let me run through each of these 6 steps below in more detail:

Step 1: Set Targets

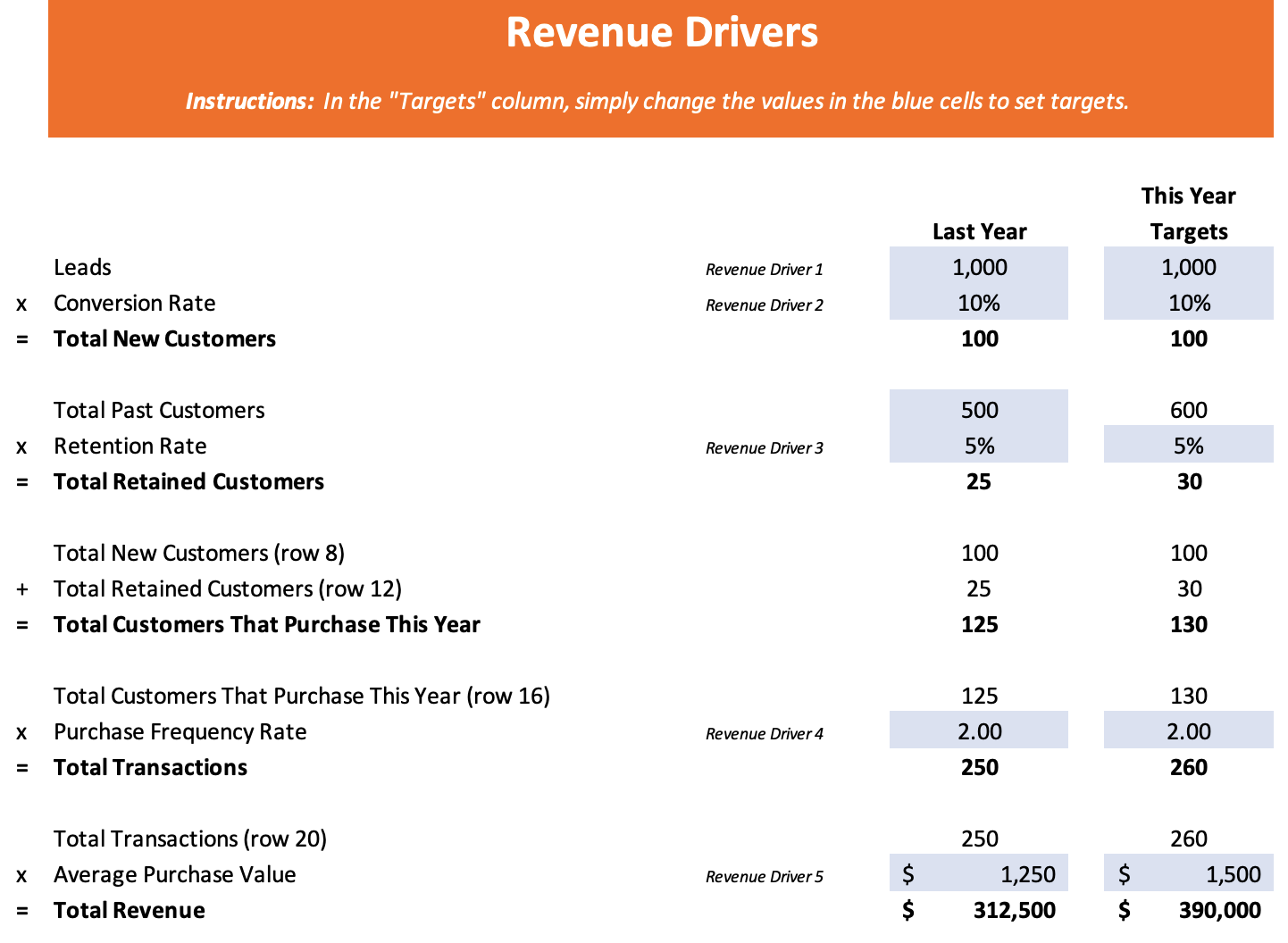

Just as I found that successful companies set targets, we too are going to set annual (year-end) targets with the One Clear Path; however, instead of these targets being subjective metrics to which executive compensation bonuses are often tied, we are going to set targets for 16 very specific, objective metrics (drivers) specifically identified to drive revenue, profit and -- especially -- cash flow.

Here are those drivers in a nutshell:

Revenue

1. Leads

2. Conversion rate

3. Retention rate

4. Purchase frequency rate

5. Average transaction value

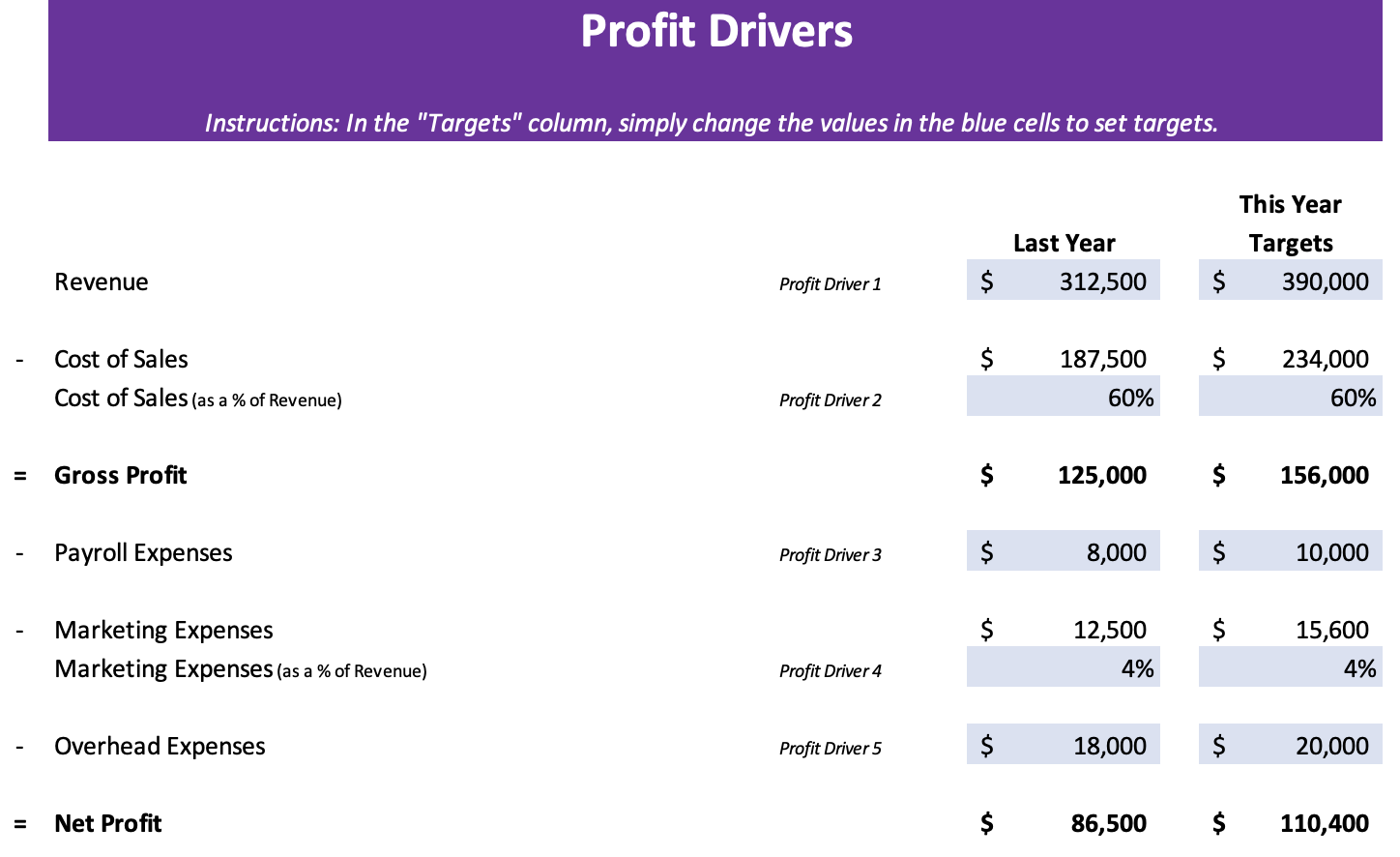

Profit

6. Cost of goods (as % of revenue)

7. Marketing expense (as % of revenue)

8. Payroll expense

9. Overhead expense

10. Other income/expense

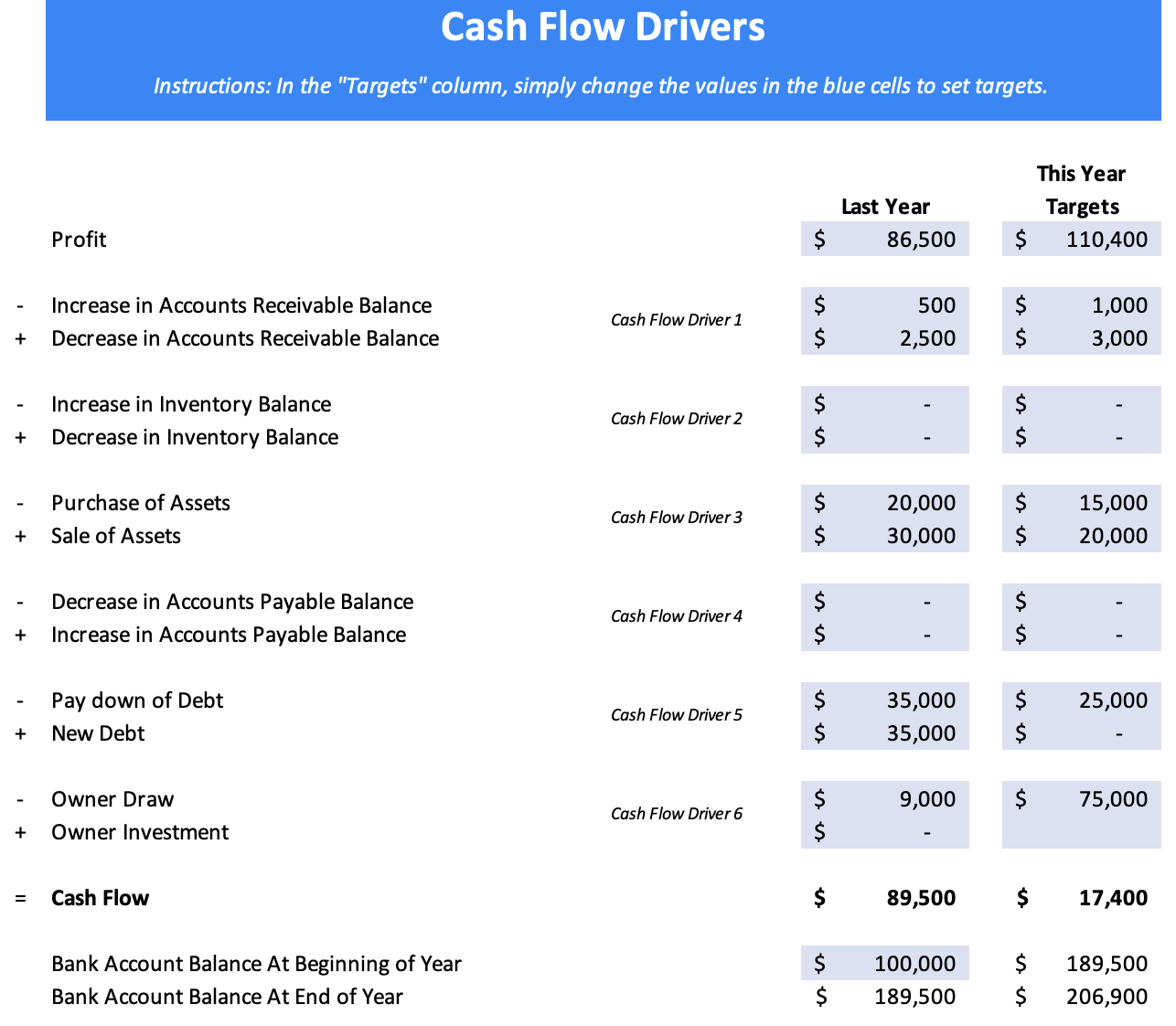

Cash Flow

11. Days Sales Outstanding

12. Days Inventory Outstanding

13. Sale or Purchase of Assets

14. Days Payable Outstanding

15. Using or Paying Down Debt

16. Owner Investments or Distributions

The core concept to understand is that, if any of those 16 metrics are improved, your business overall will improve (as measured by stronger, healthier cash flow); if 2 or more of them are improved, you'll see dramatic increases in your business's performance, and if ALL of them are improved...

You'll have a successful business beyond anything you've ever imagined.

THAT's why we set targets for all 16; they should be aggressive but realistic. If achieved, you should realize (or be on track to realize) your version of massive success.

Step 2: Update Actuals

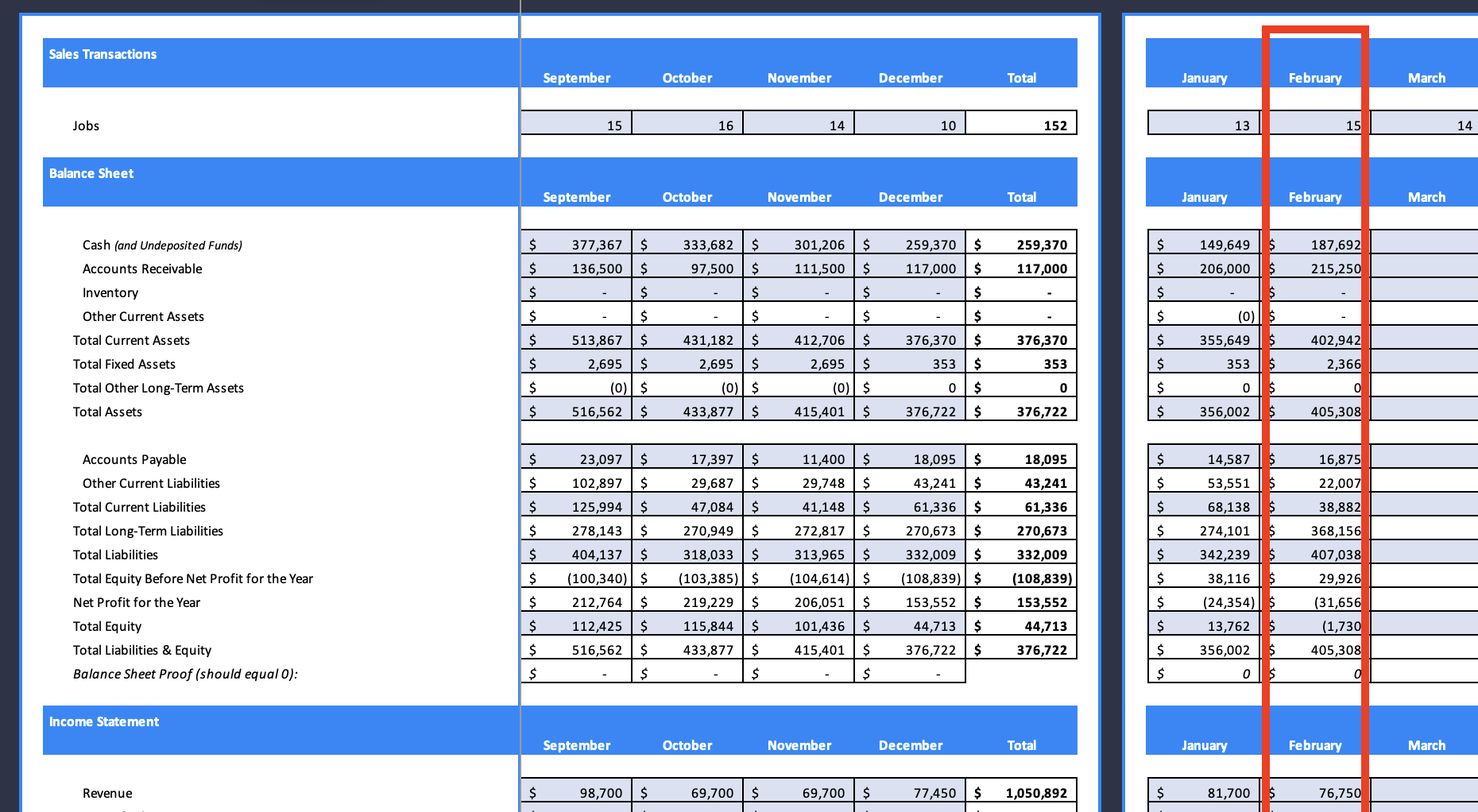

Every month, you (or a trusted expert) will update your financials based on prior month actuals. So, if you're currently in the month of March, you will update February results, and have January and February actual financials completed, from which you will derive actual values for the 16 drivers from Step 1.

(See below for an example of this step in action, where the most recent monthly actuals are inside the red box.)

WAIT! Want My Help With This?

Step 3: Create a Forecast

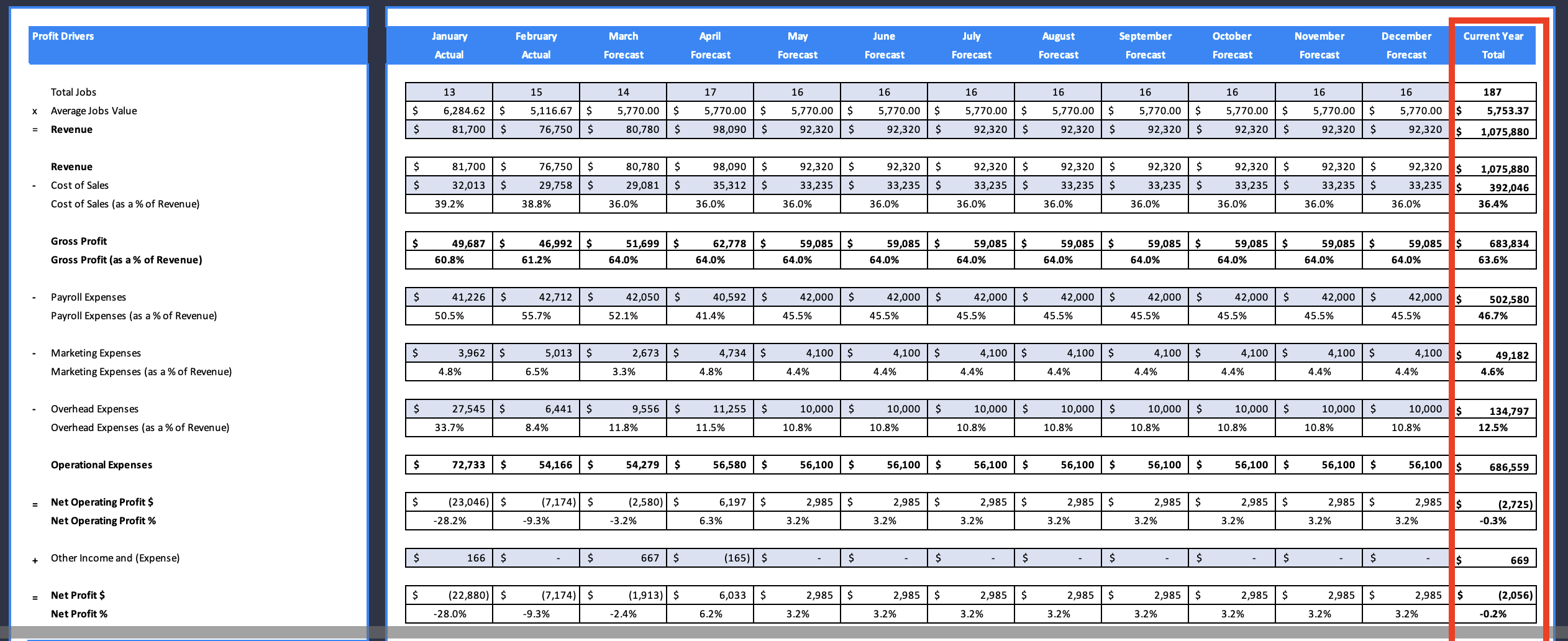

With updated actuals, you can now forecast what you believe the year-end values will be for all 16 drivers. One easy way to do this is simply to take the average value of your monthly actuals, and extrapolate for the rest of year.

For example, using the above scenario of our currently being in March, if January's Average Transaction Value is $500, and February's Average Transaction Value is $700, then you can forecast $600 for your year-end Average Transaction Value ($500 + $700 = $1,200 / 2 = $600).

(Here's an example of the Excel model I use to do this -- the forecast column is inside the red box:)

Step 4: Set Score

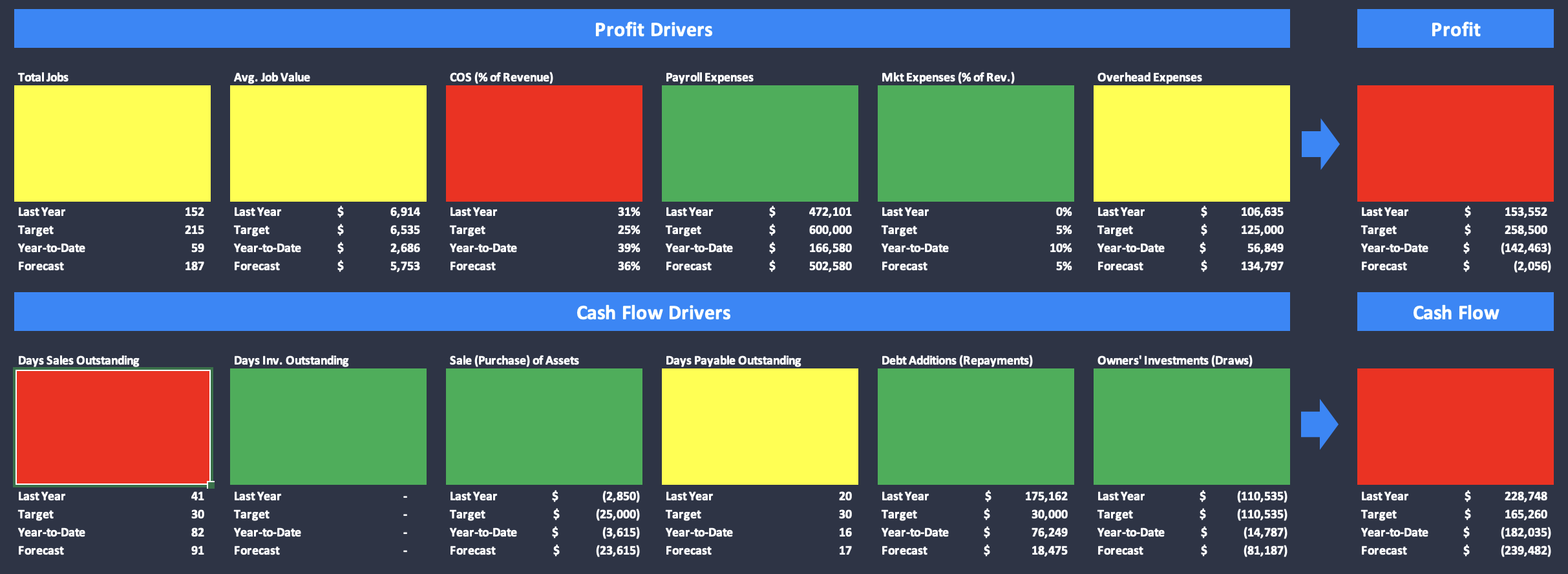

Now that you have a forecast for the year (from Step 3), you're able to compare that forecast to the annual targets (from Step 1).

Of the 16 drivers, those that are on track, based on your forecast, to hit the targets will be colored in green. This means that no course corrections are needed in the next 30 days.

Of the drivers that are not quite on track to hit the targets, but are pretty close, you will color in yellow. These may or may not require any attention.

And finally, drivers that are way off target will be colored in red; these are the drivers that need immediate attention (within the next 30 days), and they are the ones on which you should focus. If only 1 driver is in red, then by all means add in 1 or 2 yellow drivers. You should only focus on 2-3 metrics each month in order to maintain focus.

This is what a typical scoreboard might look like:

WAIT! Want My Help With This?

Step 5: Create Objectives

With a scoreboard color-coded in green, yellow and red, you're now able to see, with total clarity, what areas of your business you need to focus on improving.

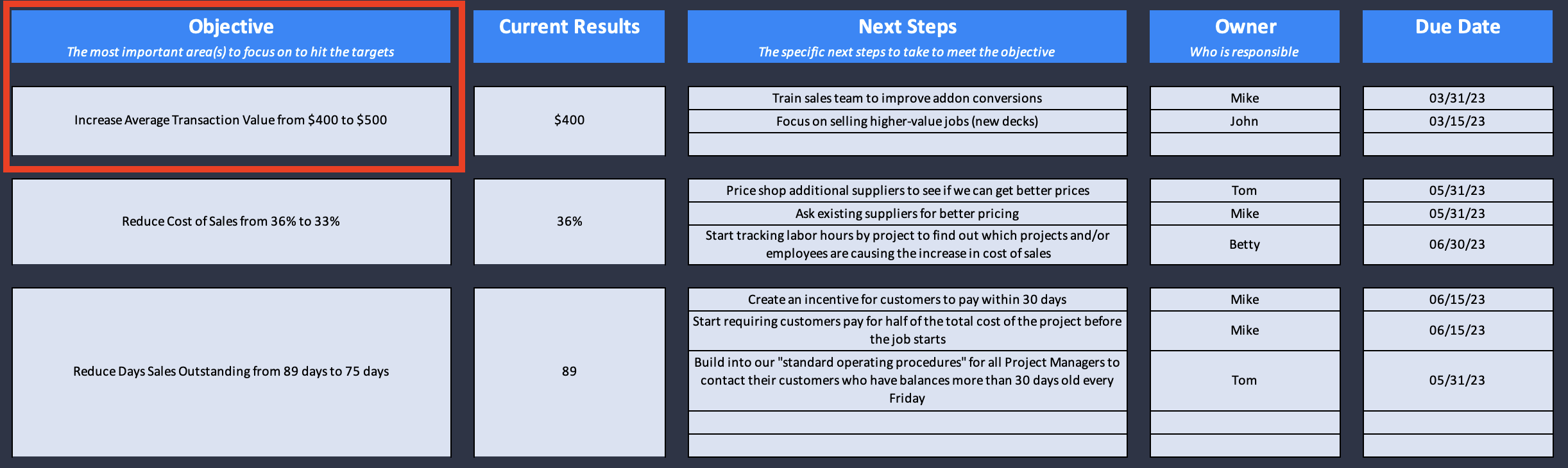

For those areas needing attention (red and maybe yellow), create 2-3 objectives to focus on for the next 30 days. These should be specific enough to give you a goal post at the end of the 30-day period.

For example:

Average Transaction Value way off target? Let's say it's $400 instead of your targeted $600. Create the following objective:

"Objective: Increase Average Transaction Value from $400 to $500 by April 30"

Notice that the objective is specific in the sense that it's quantified (increase from $400 to $500), and it contains a deadline (by April 30).

Also note that the objective doesn't have to get you all the way to your target (in this example, an Average Transaction Value of $600), it just has to get you back on track to hitting it by the end of the year.

See below:

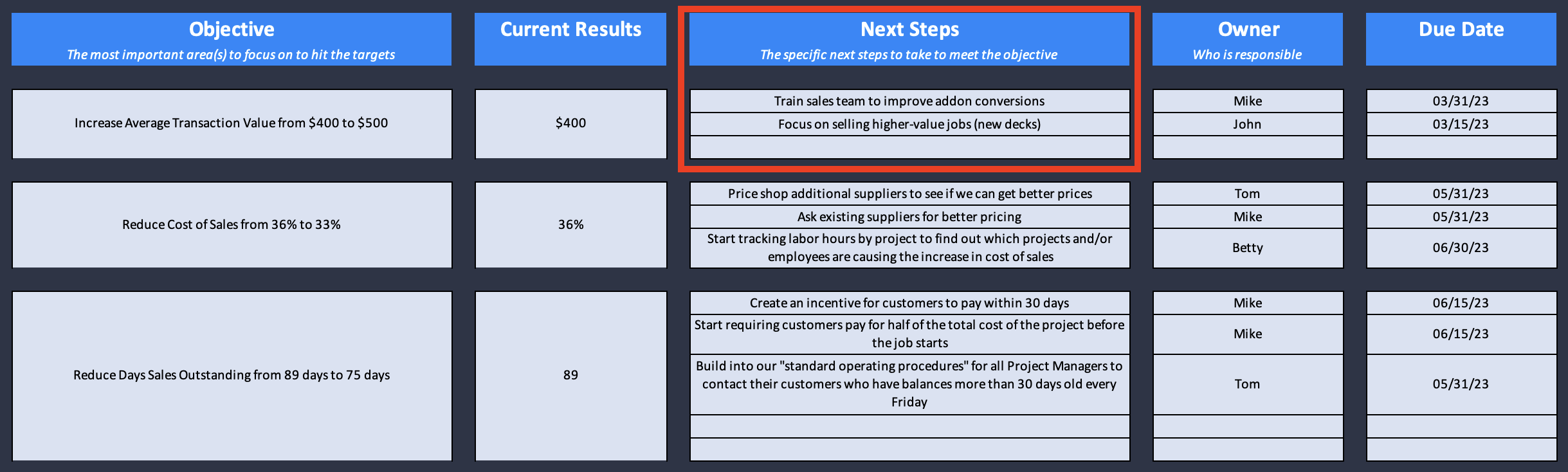

Step 6: Create Next Steps

For your 2-3 objectives, now it's time to create an action plan that delineates the specific tasks you're going to complete in order to achieve each objective. Even more so than the objectives, this plan needs to be very specific, outlining the following information:

1. Actions -- i.e. what will be done.

2. Directly responsible party (DRI) -- i.e. who is going to complete each action.

3. Deadline -- i.e. on what date will each action be completed (generally within a 30-day period).

Here's an example, using the Average Transaction Value objective of increasing from $400 to $500:

WAIT! Want My Help With This?

Why This Is So Powerful

Do you see how powerful the One Clear Path is?

Think about a washing machine. (I promise this is relevant, just hear me out...)

It has a singular purpose: to wash your clothes.

To achieve that purpose, it was designed with a number of very specific and intentional parts...

All of which must be working, in harmony, for the washing machine to perform its intended function and achieve its mission of cleaning your clothes.

But what if one of those parts breaks down? What happens?

I'll tell you what happens: the machine doesn't work! Your clothes don't come clean. Or, the washing machine works poorly, and your clothes are only partially cleaned.

Now, how do you fix the washing machine when it's broken? Perhaps you've done this before or you've hired someone to do it.

First, you identify which part isn't working... And then you fix it.

Once the part is fixed, you're golden... The washing machine operates effectively again, and your clothes come clean.

Get the point?

Your business -- any business -- is like a washing machine, made up of parts that all need to be working in harmony in order for its purpose to be achieved. In the case of business, the purpose is to make money (i.e. generate cash flow).

The reason the One Clear Path is so powerful is because it takes all 16 mission-critical "parts" of your business, sets targets for them, measures them, scores them against the targets to identify which parts are working and which ones are not, and then creates objectives and action plans necessary to fix the broken parts so your business can do what it's intended to do: make money.

It's like having an around-the-clock service provider watching over your washing machine, monitoring every load of laundry and every component part of the machine to ensure it's working at peak performance.

Once you have that for your business, it's almost impossible not to succeed.

Want Some Help With This?

While the One Clear Path is simple, it's certainly not easy. I acknowledge that.

Having worked with so many small business owners over 20 years, I understand that most entrepreneurs are great at what their business does, but they're not necessarily numbers people.

For example, an owner of an HVAC company knows HVAC systems inside and out...

...A marketing agency owner knows marketing inside and out...

...A dentist knows dentistry inside and out...

...A corporate lawyer knows corporate law inside and out...

But these subject matter experts are very often not experts in numbers. That's the tricky part about the One Clear Path... It's heavily numbers based (as it should be).

That's why I transformed virtually my entire CPA practice into an advisory business (called Clear Path CFO), so that I can do this for small business owners, as a trusted advisor. In essence, I become your CFO, and I put your business on the One Clear Path to success.

This isn't simply populating spreadsheets. I work with you to set targets based on YOUR version of success (whatever that looks like to you), then I manage all of the monthly steps covered above, culminating in monthly action plans that I work with you to create, in order to ensure you are on track to hit all of your annual targets.

I become your guide, your advisor and your confidant.

The bottom line?

You have a growing and successful business. In fact, it's my mission to ensure you have a growing and successful business.

If this sounds like something you're interested in checking out...

Next Step: Schedule a "Right-Fit" Call

Go ahead and schedule a "Right-Fit" call with me.

A "Right-Fit" call is simply a 20-minute Zoom meeting in which we chat about your business to see if I'm a good fit for you, and if you're a good fit for me. That's it. To ensure I can hit it out of the park for you, I only work with business owners that I'm 100% sure I can help.

To get started, all you have to do is simply click the button below to go to the next page, and pick the date and time that works for YOU.

Schedule a FREE 'Right-Fit' Call With Me

Not a numbers person? Most business owners are amazing at what their business does, but not necessary great at numbers. If you'd like my help implementing what you've learned on this page, go ahead and schedule a FREE 'Right-Fit" Zoom call with me. We'll determine if we're a good fit to work together, and go from there!

© Clear Path CFO, LLC. All Rights Reserved.