How To Get Through A 'Cash Crunch' And Monitor Cash Flow Like A Pro

by Todd Henry, CPA

Follow this proven cash-monitoring framework used by seasoned CFOs to navigate even the toughest cash flow crunches, condensed down to a process that you can manage in just 10 minutes a week.

Take a moment to consider this: cash flow > profit > revenue.

Pretty self-explanatory, but in essence, it boils down to the fact that cash is king. Cash flow is more important than profit, and profit is more important than revenue.

In fact, cash flow is the single most important aspect of your business because, without sufficient cash, your company fails. Every. Single. Time.

Think about it...

If every one of the 91% of all businesses that ultimately failed had been able to maintain consistent, healthy cash flow...

...Then they never would have failed.

Cash flow solves EVERY problem in business. Consider just a few examples:

Have a marketing problem? Positive cash flow enables you to hire more (or better) marketing professionals so you can generate more qualified leads (and grow your business).

Have a sales problem? Positive cash flow enables you to hire more (or better) closers so you can improve your conversion of leads to customers (and grow your business).

Have a leadership problem? Positive cash flow allows you to hire top talent to lead your company (so you can remove yourself from the day-to-day operations... and grow your business).

Have a market-downturn problem? Positive cash flow allows you to weather the storm.

Have seasonality in your business? Positive cash flow gets you through the slow times so that you can crush it during your busy season.

You get the point...

Succeeding in business is certainly a multifaceted challenge, but the absolute bottom line is, if you're able to consistently produce positive cash flow...

...Then you win. Without exception.

So, how do you ensure that your business is able to consistently produce positive cash flow?

Well, in the simplest of terms, inflows of cash have to consistently exceed outflows of cash. Once you strip away all the noise, that's really all there is to it.

Of course, that's much easier said than done. But the first step to getting and staying on the right path is to ensure that you're monitoring cash on a regular basis, and accurately forecasting cash so that you'll always know where you stand today, and where you expect to stand in the near to medium term.

This is especially critical if you're in a "cash crunch" (i.e. cash is TIGHT), because clarity is the bedrock of implementing effective solutions.

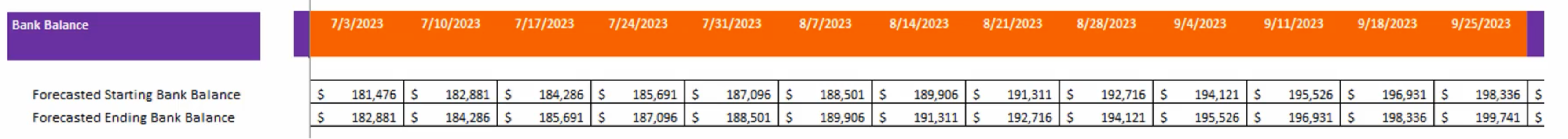

To do this (monitor and forecast cash), CFO's very often use a "13-week" cash flow model that begins with the current state of cash (today's bank balance), and projects the company's cash inflows and outflows each week over the subsequent 13 weeks in order to calculate how the bank balance will change over the period.

This is a "rolling" analysis, meaning that it's updated each week so at any given point in time, you've got your pulse on your cash position for at least the next 13 weeks.

Don't worry if that doesn't make perfect sense just yet... I'm going to show you exactly how it works, and then actually give you the SAME tool I use to perform this cash monitoring service for my clients every week.

Here goes...

The 13-Week Cash Flow Model

I've personally seen, built and used 13-week cash flow models that run the gamut from very simple (just a few rows on a single Excel sheet) to very complicated (dozens of rows spanning many tabs of an Excel workbook), and 20 years of experience has led me to conclude that with regard to the level of rigor, Prof. Albert Einstein said it best...

..."Everything should be made as simple as possible, but not simpler." (He believed that there is elegance in simplicity, and as with so many other things, he was right.)

In other words, if the model's too complicated, you run the risk of its being too convoluted and arduous to maintain (update), in which case it becomes totally useless.

However, if too simple, then it's easy to maintain, but perhaps loses accuracy and, therefore, effectiveness.

The key is to strike the perfect balance... Which I have done with the process outlined below, and the Excel Cash Flow Model Tool I've created.

It is simple enough to update in just 10-20 minutes a week (after gaining a level of mastery with it), but very sophisticated and accurate if you follow the steps.

So, without further ado...

1. Setup Steps

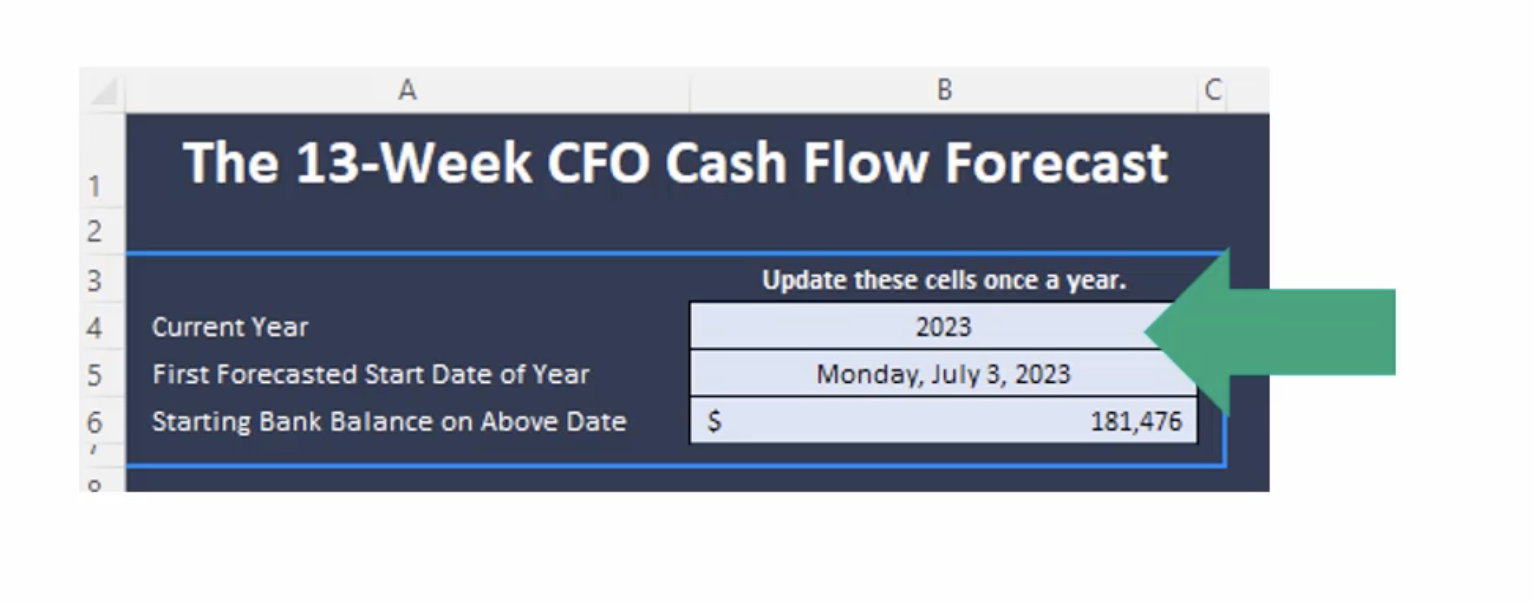

Step 1: Enter Current Year

First, you'll need to download the Cash Flow Model here.

Then open it, and in cell B4, enter the current year. See below:

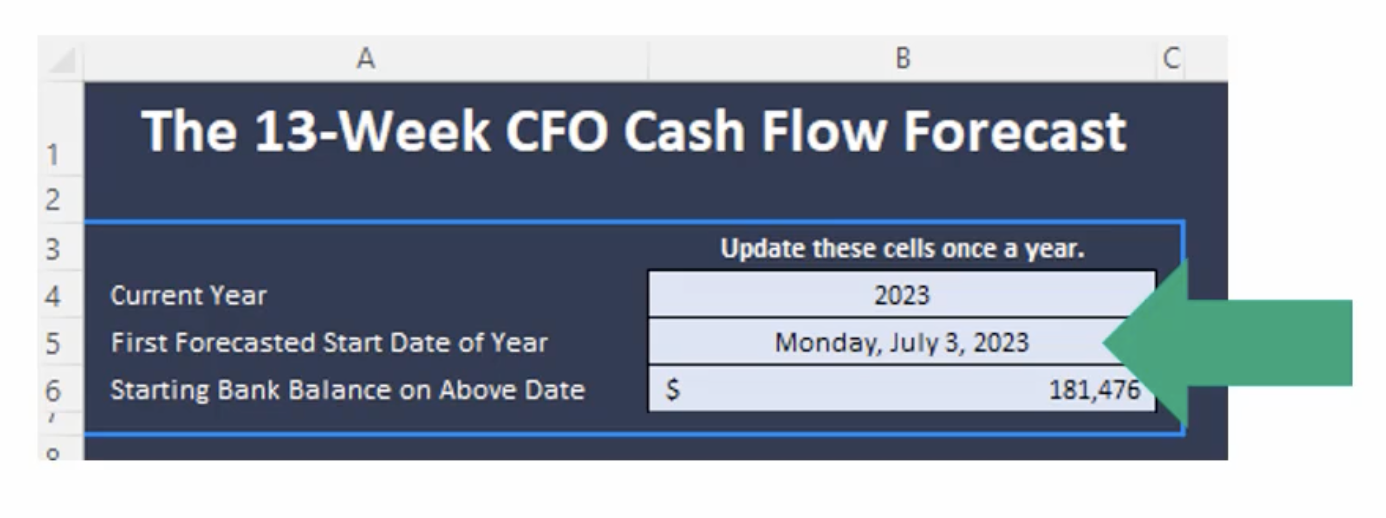

Step 2: Set the Date On Which You Want To Start Forecasting for the Year

In cell B5, go ahead and enter the date on which you want your cash forecast to begin. Again, see below:

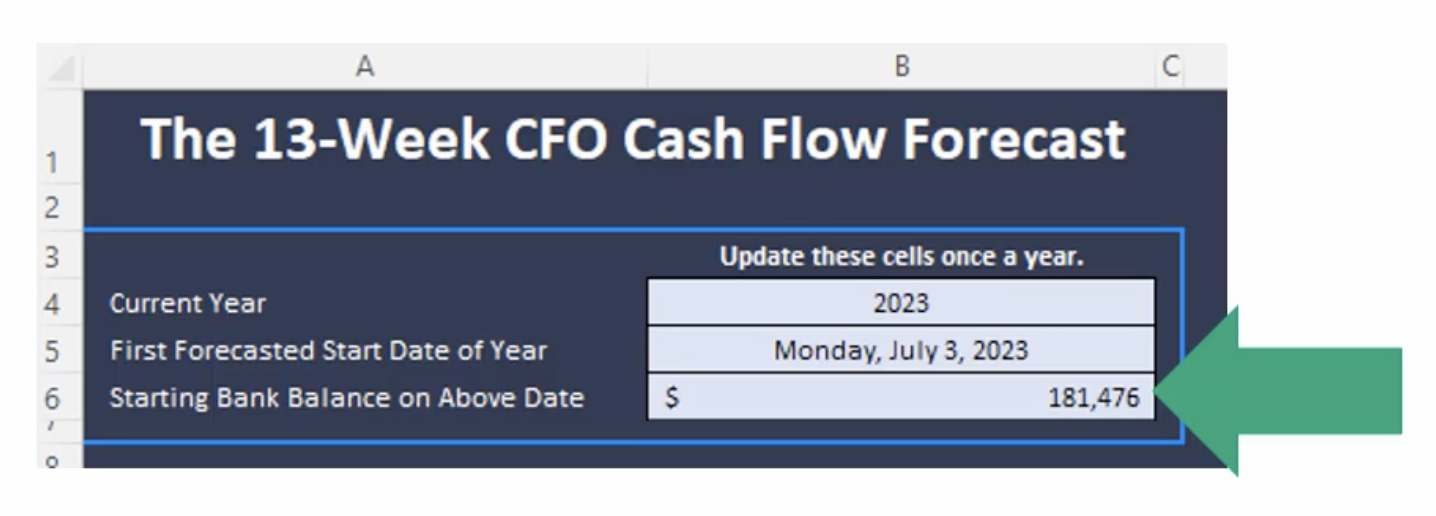

Step 3: Enter Starting Bank Balance

In cell B6, enter the bank balance for the starting date you just established in Step 2.

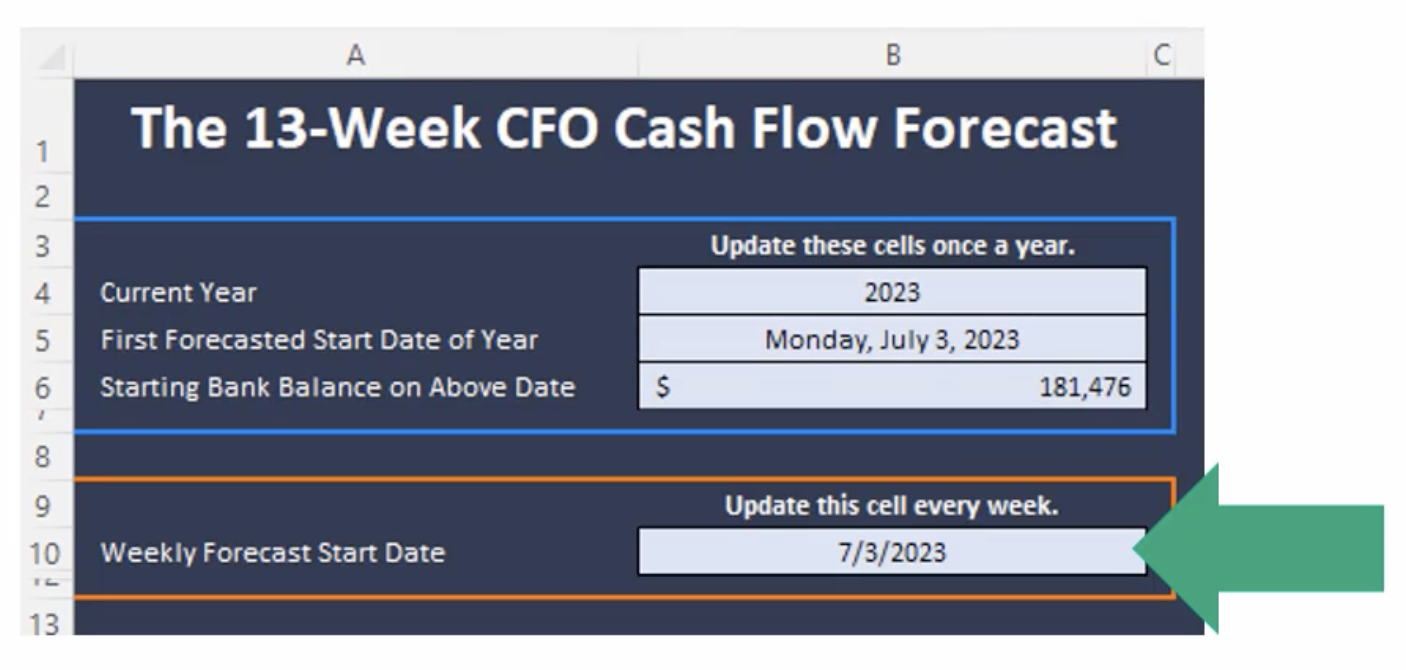

Step 4: Enter Weekly Forecast Start Date

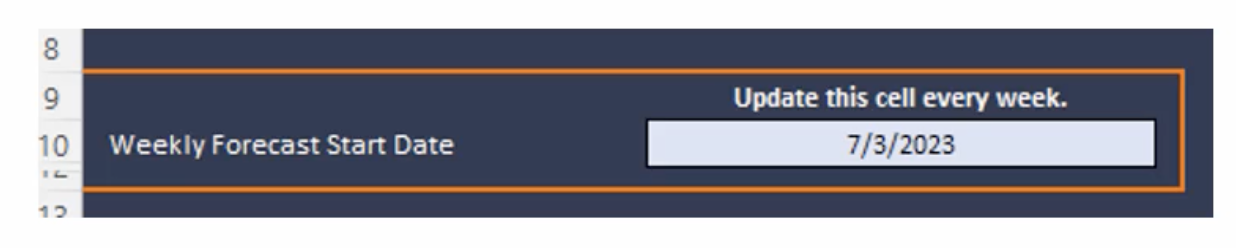

Essentially, for setup (one-time), enter the same date in cell B10 that you entered in B5 (in Step 2). This cell will get updated each week, however, with the new weekly forecast date (i.e. the first week in the rolling 13-week period).

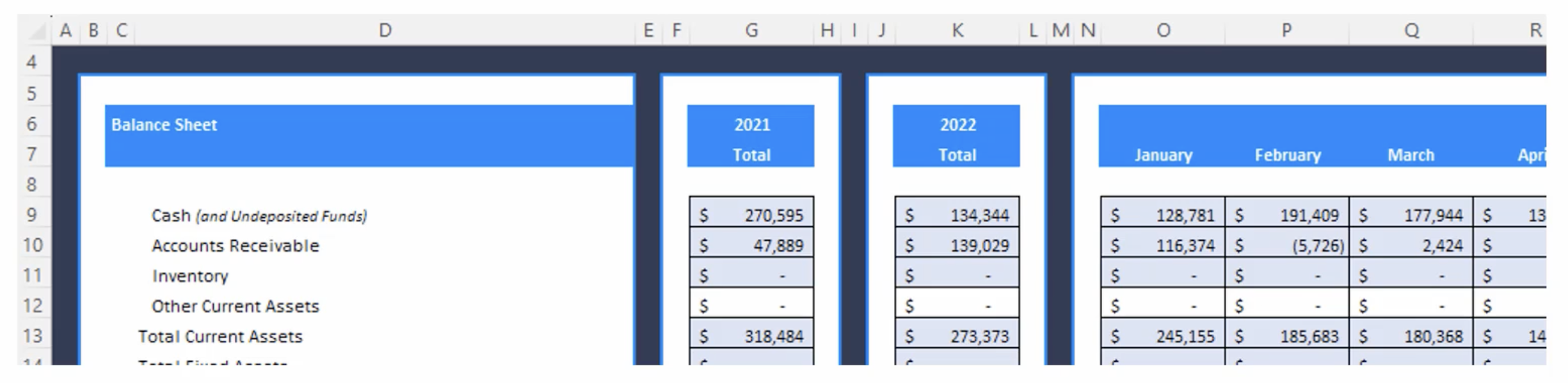

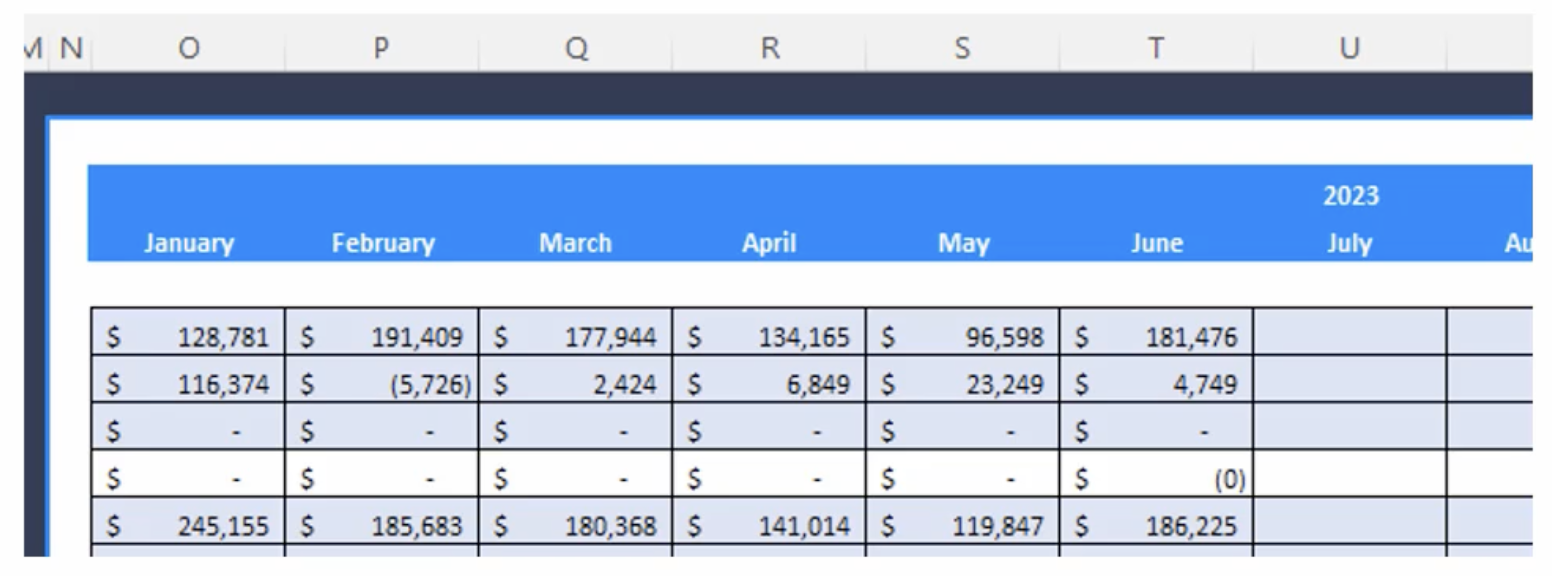

Step 5: Enter Historical Financial Data

Go to the "Actuals" tab of the Excel workbook.

Then, in the Balance Sheet and Income Statement sections of the Excel worksheet, update the appropriate fields using your financials from your accounting/bookkeeping software.

You'll do this for two years ago, last year, and current year-to-date through the last month of available financial information.

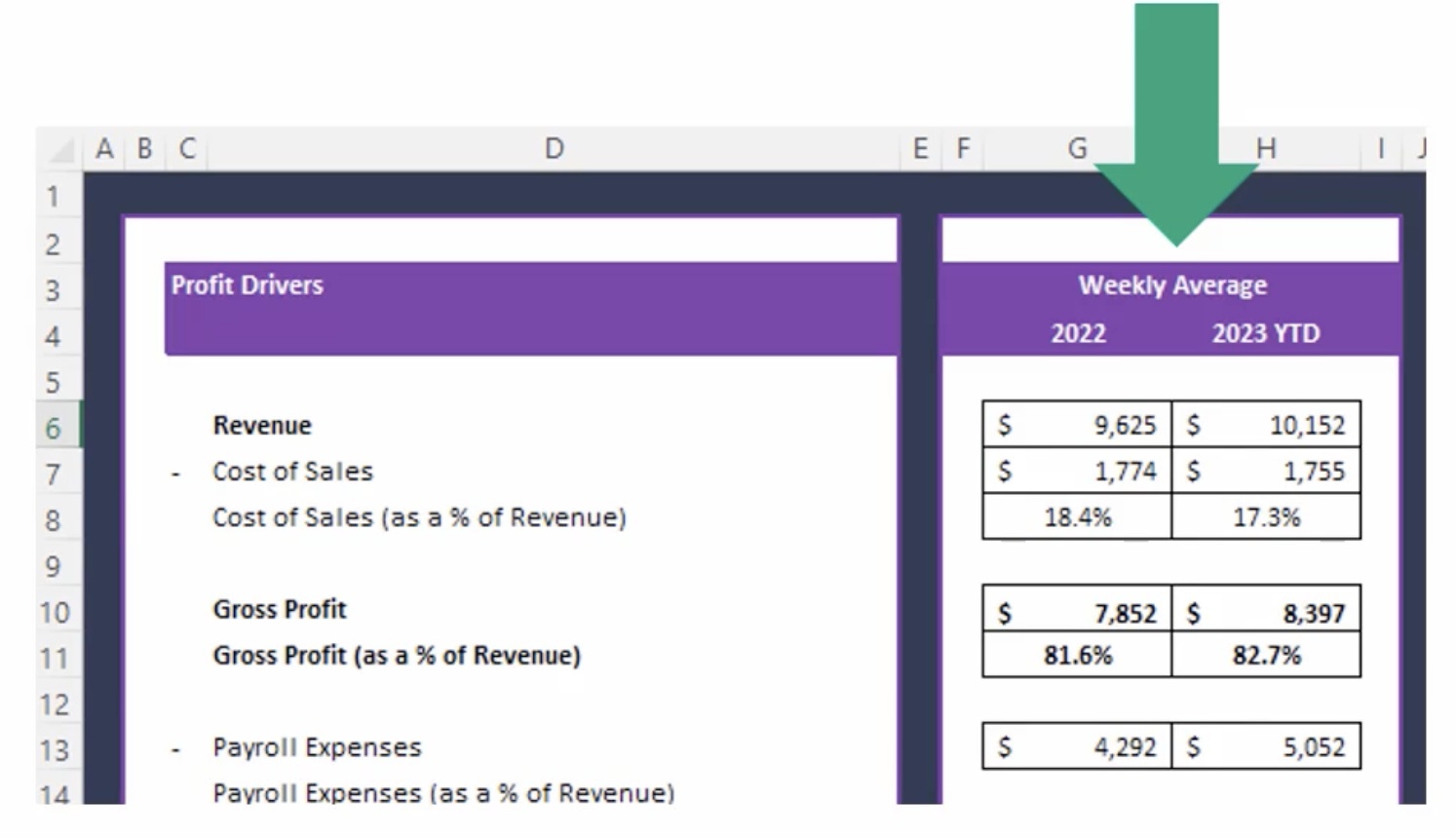

After you've completed that last step, the Excel file will automatically calculate weekly averages for various profit and cash flow drivers based on historical data. These weekly averages will help you forecast cash flow in later steps.

WAIT! Want My Help With This?

2. Weekly Forecast Steps

Step 1: Weekly Forecast Start Date

Under the "Info" tab of the Excel workbook, go to cell B10 and enter the date of the current week, representing week 1 of your 13-week cash flow forecasting period. This is the same step as Setup Step #4 (above), except that this represents the process you'll repeat every week to keep the 13-week window rolling.

(Note: Make sure that going forward, this date is updated on the same day of the week. For example, using the date of 7/3/23 shown below, you'll enter 7/10/23 next week (prior week plus 7 days) to ensure that you're rolling forward on the same day of the week.)

Step 2: Update Historical Actuals, If Applicable

(Note: This step is only required if your books have been closed since the last weekly forecast. If your books have NOT been updated, then skip this step and go to Step 3 below.)

Go the the "Actuals" tab of the Excel workbook, and update the Balance Sheet and Income Statement, for the current year, through the most recent month. This data will come from your accounting software.

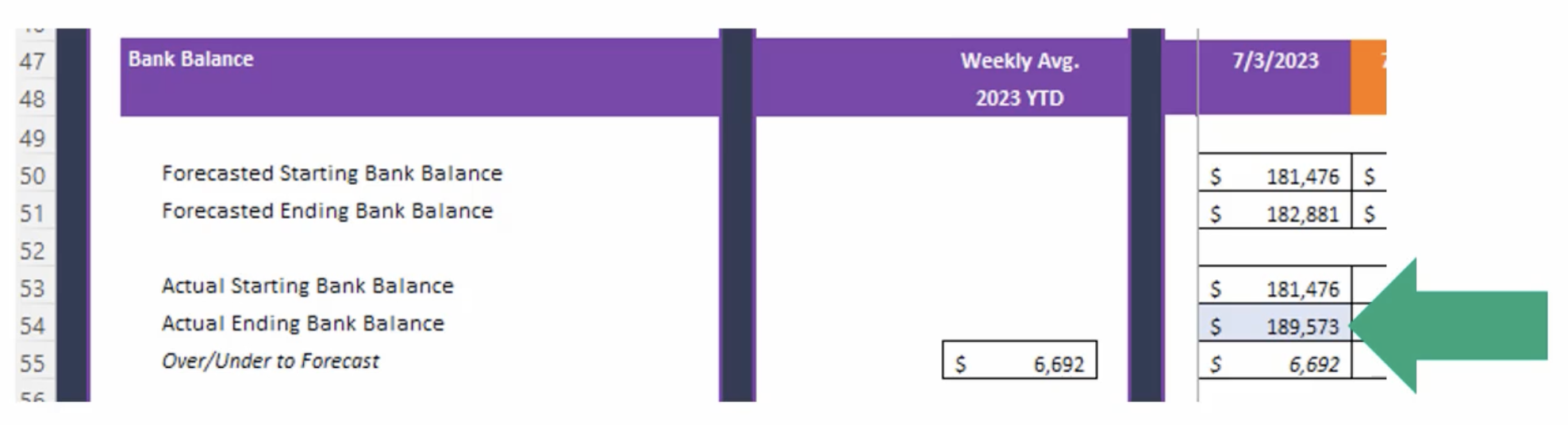

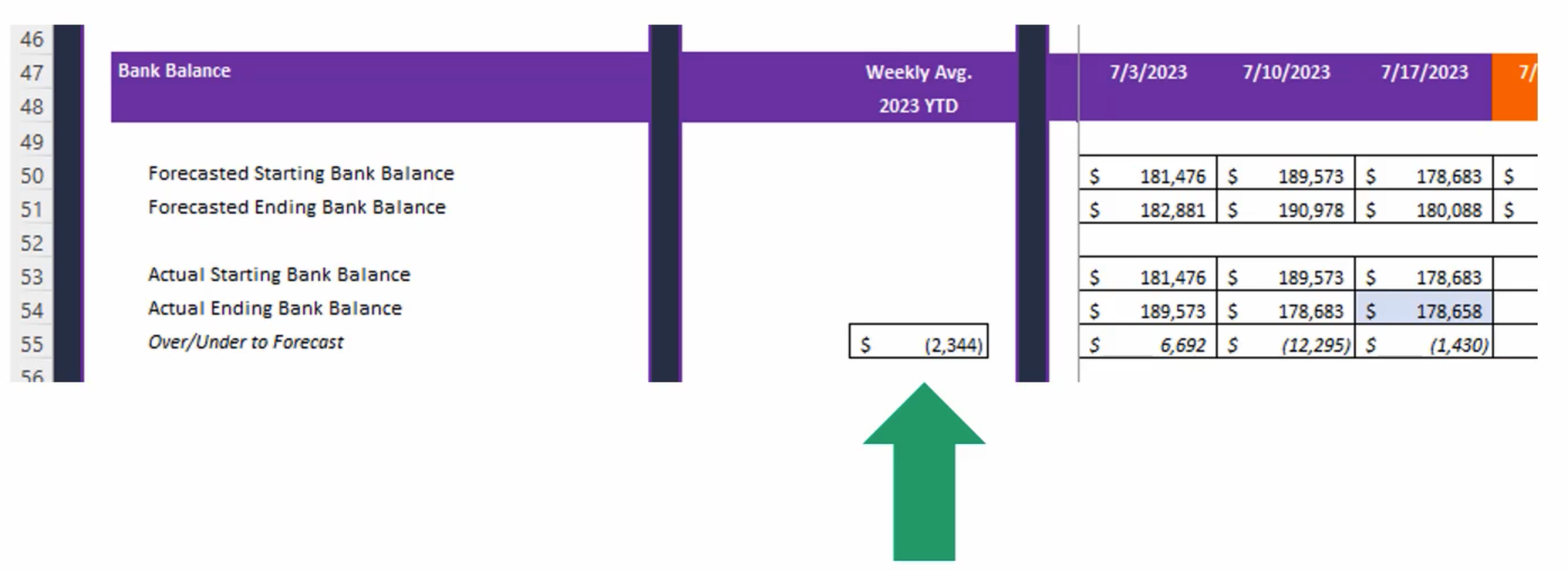

Step 3: Update Actual Ending Bank Balance

Under the "Forecast" tab of the Excel workbook, go to the Bank Balance section.

In the Bank Balance section, for each week except for the first week, enter your Actual Ending Bank Balance so that you're starting with the most accurate bank balance possible.

Step 4: Start Forecasting

Now, you're ready to actually forecast cash.

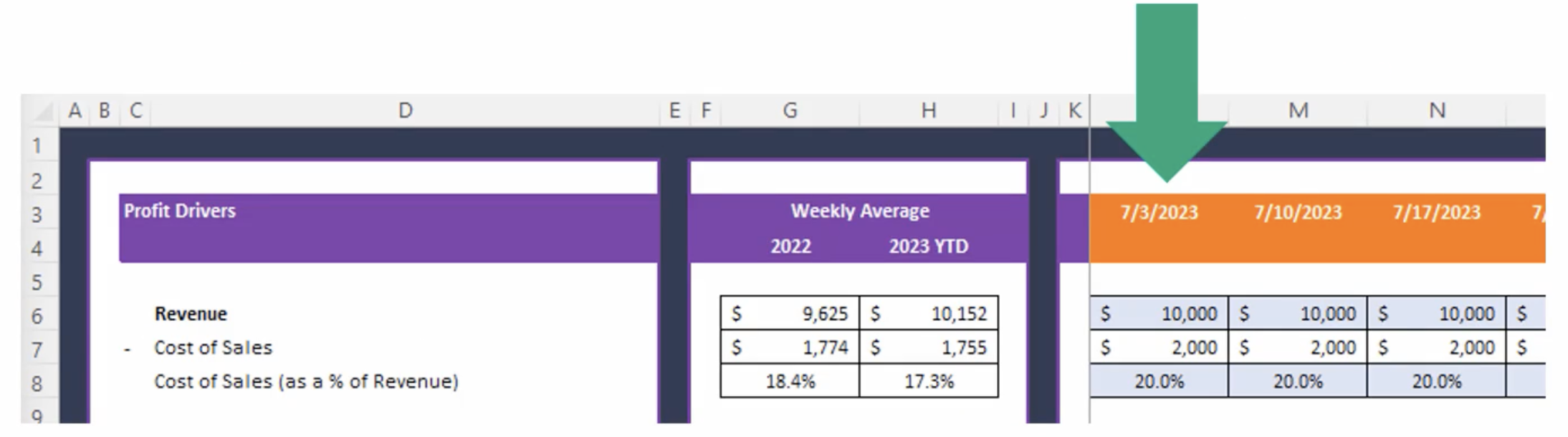

While in the "Forecast" tab, go to the first date of the forecast period (i.e. where the orange bar starts).

Now, start forecasting each of the Profit and Cash Flow drivers.

I know... At this point, I expect you're wondering, "that's great, but how the heck do I do that!?"

Well, that's totally normal, and, relax... I'm going to tell you.

Here's how to forecast Profit and Cash Flow drivers:

Use Weekly Averages

Use the weekly averages in the past to forecast the future. Remember that in Setup Step #5, I mentioned that by entering historical financial information, the Excel spreadsheet automatically calculates weekly averages of Profit and Cash Flow drivers for you. Now you know why the spreadsheet was designed to do that. Because one of the best predictors of the future is the past. Of course, you should place more weight on the most recent data, since it often predicts the future better than older data.

Look at Recent Historical Data

Alternatively (or, additionally), you can go to the "Actuals" tab and look at the past few months to determine how much your business has generated for each of the Profit and Cash Flow drivers in the recent past.

Consider What You Know About The Next 13 Weeks

This one's easy but often overlooked. Ask yourself: "Am I aware of any significant or one-time cash inflows or outflows over the next 13 weeks?"

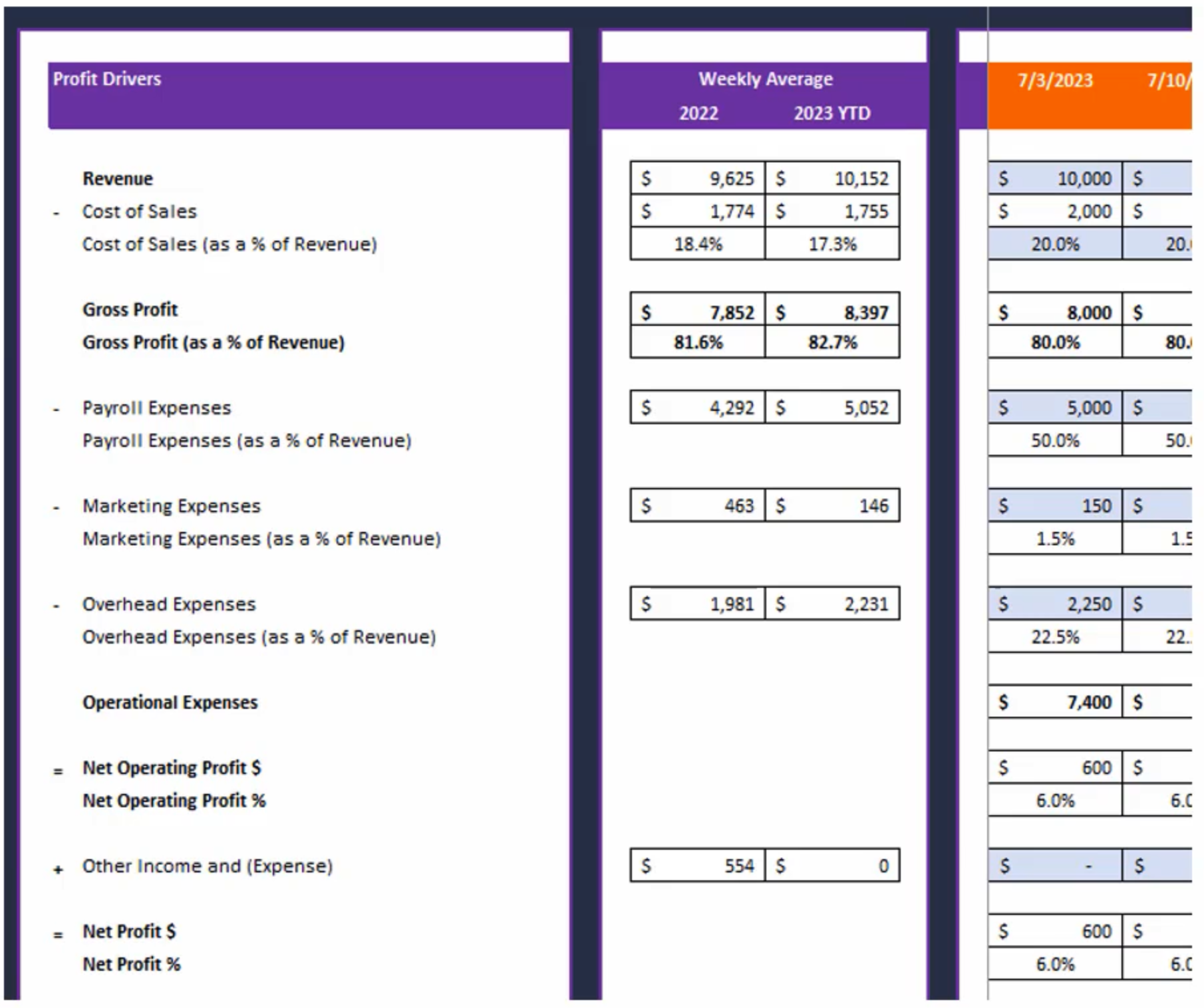

Now, using the above 3 criteria, you'll forecast the first 13 weeks (for the weeks colored in orange), with respect to the following Profit Drivers:

1. Revenue

2. Cost of Sales (as a % of Revenue)

3. Payroll Expenses

4. Marketing Expenses

5. Overhead Expenses

6. Other Income/Expenses

Each of the above Profit Drivers drive profit, which obviously is a main driver of Cash Flow.

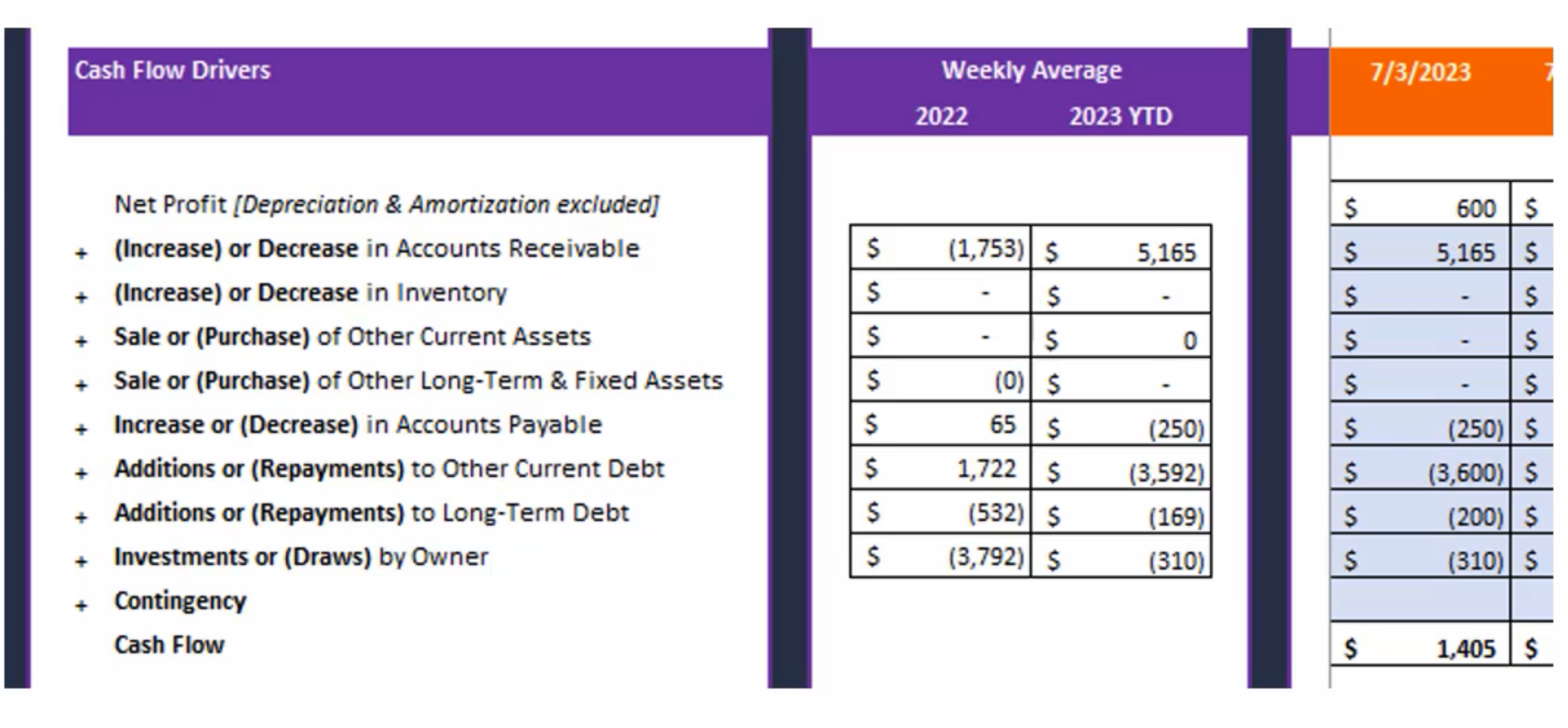

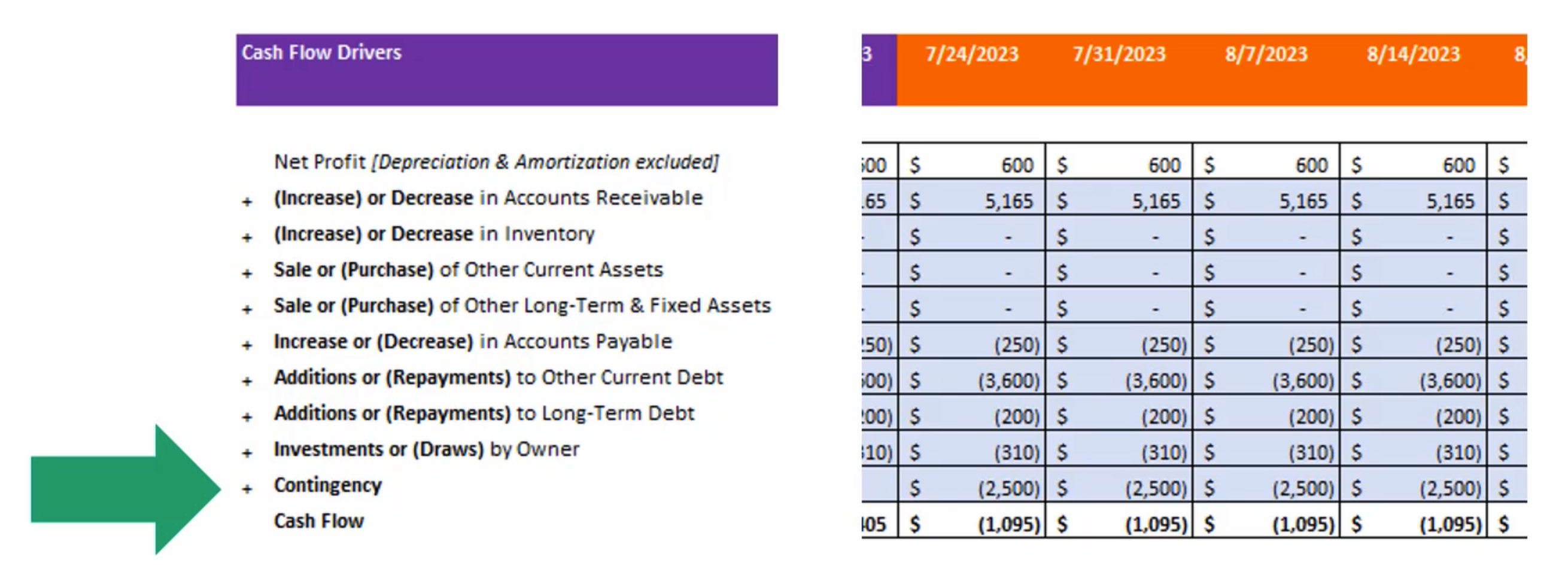

Then, proceed to forecasting the first 13 weeks with respect to the following Cash Flow Drivers:

1. (Increase) or Decrease in Accounts Receivable

2. (Increase) or Decrease in Inventory

3. Sale or (Purchase) of Other Current Assets

4. Sale or (Purchase) of Long-lived or Fixed Assets

5. Increase or (Decrease) in Accounts Payable

6. Additions or (Repayments) to Other Current or Long-Term Debt

7. Investments or (Draws) by Owners

After you've forecasted your Profit and Cash Flow Drivers, now you can go to your Balance Balance section to see your forecasted Cash Flow and forecasted Ending Bank Balance for the next 13 weeks.

Step 5: Update the Contingency

Remember that no matter how sophisticated, a forecast is still an estimate (an educated guess about the future).

If you download the Excel template and follow the steps outlined above, you can be confident that your forecast will be as reasonably accurate as possible with the information available...

... But it won't perfectly hit your actual ending bank balances. Inevitably, you will forecast under or over the actual number by some amount.

That's why we add in a contingency.

You see, the Excel spreadsheet will calculate how much, over time, your forecasted bank balance is over or under the actual Ending Cash Balance for each week, and places that average in the "Over/Under to Forecast" cell.

Based on the value in that cell, you need to enter a contingency for the next 13 weeks to correct how much over or under you expect to be based on how much you've been over or under, on average, in the past.

For example, using the Over/Under shown above of ($2,344), you may want to include a contingency of ($2,500) every week to account for the fact that, on average, your forecasted cash flow has been $2,344 more optimistic than has panned out in reality. See below.

(Note: If your forecasts, by contrast, have consistently been pessimistic -- i.e. your actual ending bank balances have been higher than you've historically forecasted -- then I would advise you to enter a "0" contingency, since it's best to be conservative when estimating cash flow.)

After that last step, you've successfully completed a cash flow forecast for the next 13 weeks!

Using this cash flow forecasting process, you'll be able to predict cash flow more accurately than if you were simply guessing cash inflows and outflows the traditional way.

Remember, each week, you will repeat the "Weekly Forecasting Steps" in order to keep the 13-week cash flow model rolling, so you'll always know your expected ending bank balances for the next 13 weeks.

WAIT! Want My Help With This?

Why This Is Crucial For Your Business

There's a reason why so many companies, often from middle market to Fortune 500, use a 13-week cash flow forecasting model, like the one outlined above...

... Because they're not only crucial for planning and decision making, but even for survival.

I'd argue that it's even MORE important for small businesses to use this critical tool because, unlike corporate giants that have many access points to cash in a cash crunch (e.g. stock issuance, investor calls, investment banks, savings & loan institutions, etc.), small businesses have far fewer options, with higher stakes.

If a small business owner over-leverages, for example, and then goes under (which happens all the time. 91% of small businesses eventually fail)... (S)he is left with no business and a pile of debt...

... Or if credit dries up in a recession and a small business can't generate enough cash from operations to make it through its slow season...

... Or if an unforeseen event (lawsuit, pandemic, natural disaster, supply chain disruption) occurs and there's not enough "reserve" cash to weather the storm...

You get the point.

Monitoring and predicting your available cash on hand is not only a critical aspect of running a business, it's also vital to its survival.

Make sure you're doing it, or hiring it out to have an expert do it for you.

Which brings me to my last point...

Want Some Help With This?

While this 13-week cash flow process is simple, I won't claim that it's easy.

It's not.

There's a lot of experience involved in knowing what assumptions to "bake" into the weekly forecasted Profit and Cash Flow drivers. Things like:

- Seasonality of your business

- Industry factors (e.g. emerging trends, market competition, etc.)

- Economic factors (e.g. inflation, labor market, supply chain, consumer expectations, etc.)

- Trend analysis (e.g. revenue trend, market share, etc.)

... And more.

It's not easy.

However, it doesn't have to be easy for you. In fact, you don't have to deal with it at all while still reaping all the benefits...

If you'd like to have ME do this for you, so that you can focus on what YOU do, then I'd like to help out.

Here's what to do:

Next Step: Schedule a "Right-Fit" Call

Go ahead and schedule a "Right-Fit" call with me.

A "Right-Fit" call is simply a 20-minute Zoom meeting in which we chat about your business to see if I'm a good fit for you, and if you're a good fit for me. That's it. To ensure I can hit it out of the park for you, I only work with business owners that I'm 100% sure I can help.

To get started, all you have to do is simply click the button below to go to the next page, and pick the date and time that works for YOU.

Schedule a FREE 'Right-Fit' Call With Me

Not a numbers person? Most business owners are amazing at what their business does, but not necessarily great at numbers. If you'd like my help implementing what you've learned on this page, go ahead and schedule a FREE 'Right-Fit" Zoom call with me. We'll determine if we're a good fit to work together, and go from there!

© Clear Path CFO, LLC. All Rights Reserved.